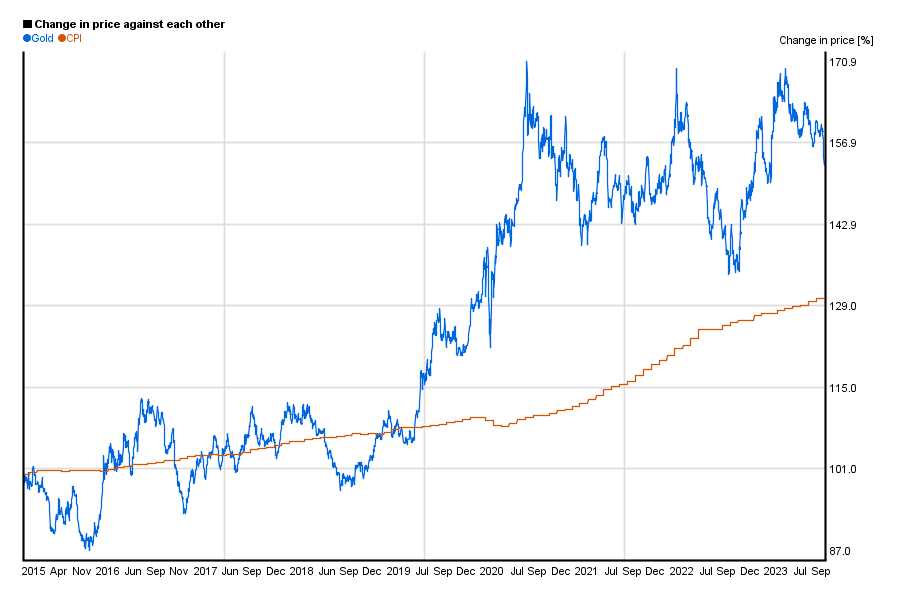

Similarly, Platinum’s use in jewellery has grown rapidly in the last 25 years, before which it was almost nonexistent. Platinum is predominantly used in combustion engine catalytic converters in car manufacturing and understanding the growth of demand for Platinum from the automobile industry is important. There exists ongoing political risk and production is often cut as a result of labor and Union disputes, the impact of rolling blackouts as well as unstable power and water supply and even foreign currency fluctuations. With South Africa responsible for approximately 72% of the world’s newly minted Platinum (the rest originating from Zimbabwe and Russia), an understanding of the supply chains on the ground in South Africa are critically important. The market conditions applicable to Silver, are much like that for Gold, and tend to be driven by monetary policy, the value of the US dollar, geopolitical concerns, physical demand as well as the available supply from mining production.Īs a commodity that is the least reactive, rarest and densest metal on Earth, Platinum’s value is determined by a complex interaction of supply and demand fundamentals. Silver is well regarded as a safe-haven asset for investors during times of economic upheaval, uncertainty and financial stress. Whilst the price of Silver is well known for being more volatile than Gold due to its smaller market size, lower market liquidity as well as ever-changing supply and demand from the industrial sector and its properties as a store of value over long periods of time. The price of Silver, like many other commodities, tends to be driven by a combination of supply and demand metrics as well as speculation. Perth Mint 2023 1oz Dragon Rectangular CoinīHAS 14.329kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.459kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.593kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.626kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.974kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.747kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.758kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.864kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.881kg Silver Bar Cast 999 (SYD Collection Only)īHAS 14.884kg Silver Bar Cast 999 (SYD Collection Only) New Zealand Mint 2022 Niue Owls Silver Coin – 1oz South African Mint 100 x 1oz Silver Bullion Krugerrand Coin South African Mint 1oz Silver Bullion Krugerrand Coin Ultimately, as the flow of cash into the Gold market increases, the supply of Gold decreases, causing the price of Gold to rise. dollar relative to a basket of foreign currencies), the amount of Gold procured by or held within Central Bank reserves, as well as worldwide appetite for holding Gold as a hedge against both rising inflation and currency devaluation.Īll of the above factors combine to drive the price of Gold. index which highlights the value of the U.S. The most important factors include the overall global demand for Gold, interest rates on financial products and services, the value of the United States Dollar (measured via the U.S.

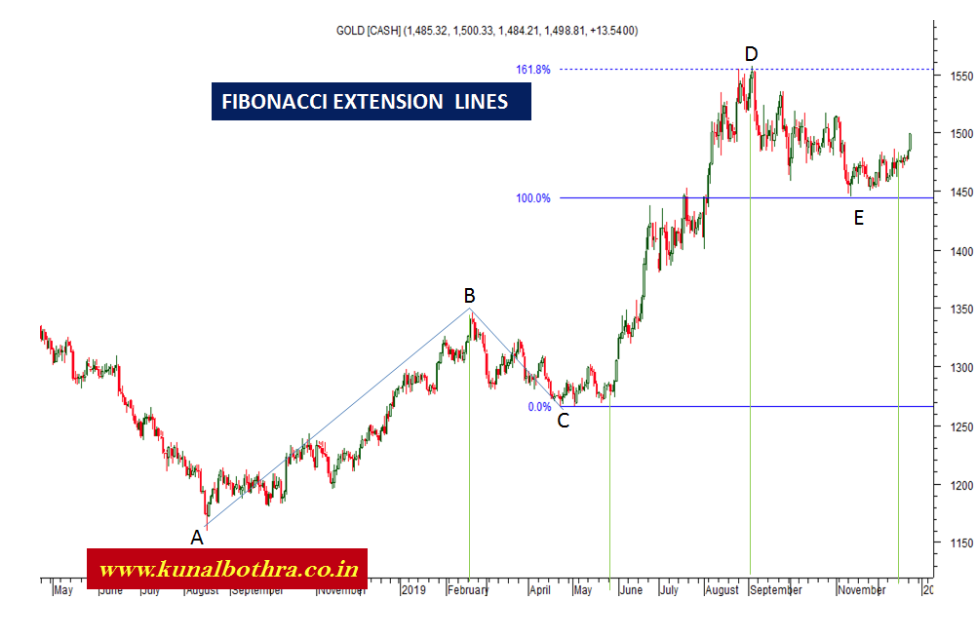

There are many factors that affect the price of Gold. Perth Mint 1/2oz 2023 Lunar Rabbit Gold Coin – Limited Stock Perth Mint 1/4oz Gold Coin Kangaroo delivery delay appx 7 days Perth Mint 1/4oz 2023 Lunar Rabbit Gold Coin – Limited Stock Perth Mint 1/10oz 2023 Lunar Rabbit Gold Coin – Limited Stock Exchange Rate: AUD to USD - 0.6718 Product

0 kommentar(er)

0 kommentar(er)